The new frontier of sustainable finance: ESG

The world of finance is constantly evolving: the interests of both investors and the community are unstable. In response to diverse information and investment needs, economic agents develop appropriate instruments to meet the demands of the public with whom they interact.

Nowadays, investors look not only at financial achievements, but also at the impact their investment has had in the economic eco-system of reference. It is in this light that the concept of ESG was born. ESG (Environmental, Social and Governance) is a criterion of sustainability rating aimed at certifying the solidity of the issuer, from the environmental, social and governance point of view.

According to a study conducted by NMG Consulting[1], 85% of European financial consultants have clients, most of which retail investors, allocated in ESG funds. Furthermore, research has illustrated how in Italy and France, nine out of ten consultants see responsible investments as an opportunity for corporate growth.

Amongst the investment strategies that have registered a substantial increase in the last few years there is impact investing, which alludes to investments in firms, organisations or funds, established with the intention of generating a measurable socio-environmental impact and, at the same time, a positive economic return.

In spite of the fact that the existence of a link between equity securities’ performance on the market and their ESG nature has not been proved yet, scientific literature seems to point in that direction. Eccles et al. (2014) found that the 180 analysed firms and considered “excellent” in terms of sustainability, had better operations and market performance than their counterparts which did not adopt ESG practices. Similar results were obtained by Dimson et al. (2015) and Khan et al. (2016)[2].

The so-called green economy has affected and still grips the relationship between banks and companies. Banks, which are the principal sources of financing for Italian companies, use ,for credit valuation, an evaluation of the socio-environmental impact as well as traditional economic and financial criteria. The less virtuous firms under the socio-environmental aspect are hindered to access lines of credit, whilst the most sustainable ones are offered privileged conditions.

However, it should be noted that there is still not a developed legal framework neither for the definition of “environmental”, “social” and “governance”, nor for the duty of integrating these types of assets to investment funds. The EU seems to be at the forefront under this profile since the ESMA has recently delivered the first European taxonomy of ESG assets[3]. Moreover, a strong improvement in data collection and analysis is to be expected due to technological progress,, for instance artificial intelligence.

The Italian scenario

In Italy, ESG investments are not a developed market. Sustainability is appreciated, but on a theoretical basis rather than a practical one. Indeed, just a small share of investors follow through, effectively choosing ESG solutions. According to Schroders[4], the reason behind this could be related to a “limited awareness of the positive impact their investments can have in the future”. However, a further proof of the necessity of enhancing financial information lies in the following fact: investors that consider themselves more “expert” are the ones that tend to invest more in a sustainable way. In Italy, the experts that invest in sustainability are the 18% compared to the 23% on a global level, against the 8% of italians with intermediate knowledge (11% the global figure) and the 7% of investors with basic knowledge (8% the global figure).

How to adapt to changes: the example of Mikro Kapital

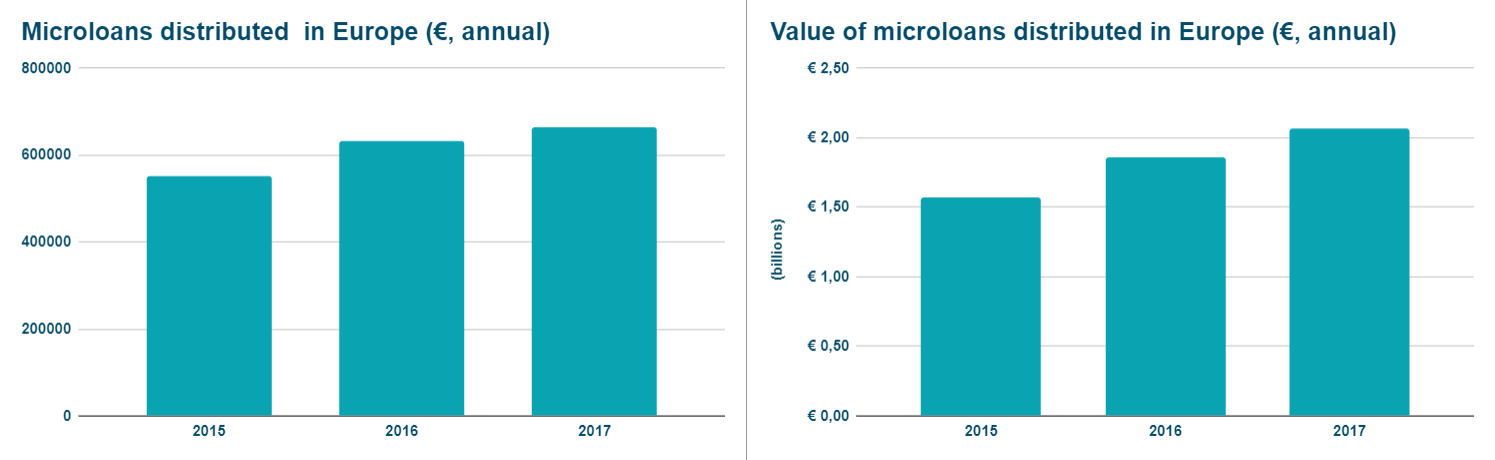

Within the European and International microfinance framework, the labour of the firm Mikro Kapital must be mentioned. Founded in 2007 and operating on an international level, Mikro Kapital provides financial flows for niche markets, with a particular interest in the emerging sectors.

This business offers sustainable financing services both for companies and for people by observing the customer, putting him at the center of all actions and working to achieve sustainable and profitable growth.

The competitive advantage of Mikro Kapital lies in the speed of credit delivery, which is resolved in seven days, in its flexibility (the customer can in fact choose the most suitable repayment plan up to a maximum of 60 months) and in the stability of fixed interest rates.

The company looks at the future with positivity: good organic growth is expected in the demand for micro-credits. In fact, more and more small entrepreneurs, generally not appreciated by banks, rely on microfinance to find services tailored to their needs. The optimism of Mikro Kapital is confirmed by the stability that the vast majority of customers boasts even in a period of crisis like the current one. The work of this fund, in fact, has always focused on small and medium-sized cities that have suffered less restrictions than large urban centers. SMEs credit applicants are usually family-run, characterised by flexibility and subject to little bureaucracy, driven by a great tenacity that makes them capable of adapting to crisis situations.

In a climate of crisis and uncertainty such as the one caused by the pandemic, microfinance can be a useful tool to get back to normal. Small entrepreneurs need liquidity to buy products, pay rents and return to normal operations, which is why Mikro Kapital is reinforcing digital services, expanding the range of products offered and modifying the credit measures so that they are adequate with the turnover and timing of credit return.

The close collaboration with this investment fund enables Aleph to widen their impact in the financial world. Mikro Kapital’s services offer development and growth opportunities to players aligned with ESG factors, in light of impact investing, to operate in the financial context with a social return. Our objective is that of generating opportunities to have a positive impact in the scenario of growth of the world of finance.

The challenges of the world of finance: actions and reactions to stand to the pandemic

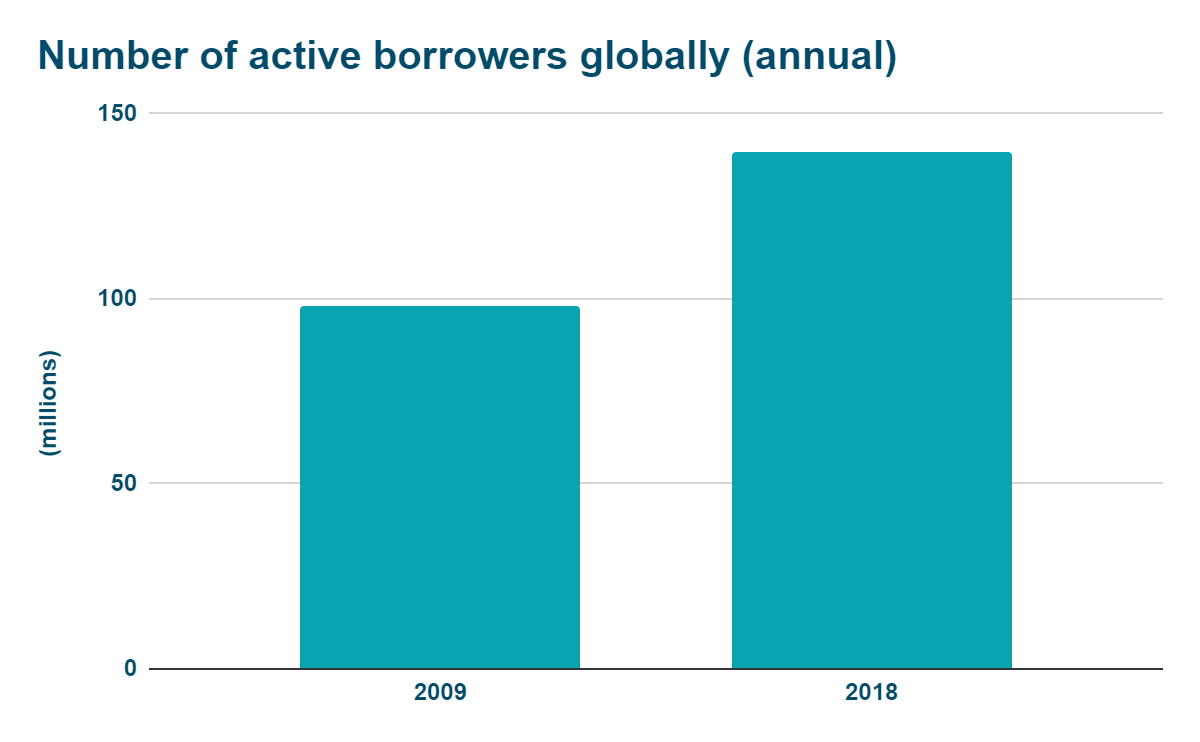

Over the past 30 years, the microfinance field has seen an exponential growth of the stakeholder audience, reaching about 139 million customers globally (Convergences 2019[5]). This trend, however, is likely to come to a setback due to the COVID-19, which has put in severe difficulty many companies operating in the sector.

In Pakistan, the fifth most populous country in the world and home to a large and mature microfinance sector, there has been a 90% decline in family income, bringing 70% of the interviewed sample of regular borrowers to declare that they are not able to meet the required payment on their loans – according to surveys by the Oxford Review of Economic Policy[6]. The short-term economic crisis of the borrowers therefore led to a liquidity crisis for the lenders.

The repercussions have not only affected the volume of business, but also the internal organisation of the companies: the remuneration of loan officials has been challenged, since a significant percentage of their total income were performance-related payments based on new loan disbursements and repayments of existing loans.

The pandemic has affected all industrialized countries, but with different intensity: the inability to collect savings affects 56% of MFIs (Monetary and Financial Institutions) surveyed in sub-Saharan Africa and 60% of those in South Asia, while the issue is less critical in other regions. The same applies to portfolios at risk, which for 80% of respondents – globally – are qualitatively deteriorated.

It is evident at this point that uncertainty grips economic realities in the present situation and risks leading to a deadlock; nevertheless, there is no doubt that the MFIs, worldwide, are trying by all possible means to adapt to the crisis, demonstrating proactivity and reactivity, deciding to actively tackle the consequences of the global economic recession.

Measures to mitigate the effects of the crisis include the restructuring of customer credit, the slowdown in credit delivery, the increase in customer loans in sectors least affected by the crisis (such as agriculture) and greater transparency in communication with stakeholders.

One of the most useful tools is technology, both in terms of improving communication with customers and for the management of financial products. It’s pushing for a digital ecosystem to expand services remotely. Some countries saw 30% or more increases in mobile finance app downloads during the crisis. This phenomenon has a trickle-down effect to companies in the activation of emergency measures in case of crisis through the opening of wholesale accounts and through a greater and facilitated use of mobile portfolios.

“We are conscious that we have to deal with a “new normal” and that it will be very unlikely that we will be able to return to the world we knew before.” affirms Enrico Danieletto, CEO of Aleph Finance Group. However, Danieletto believes that “the post-pandemic world offers multiple new scenarios and opportunities for entrepreneurial initiatives. Thanks to their extreme flexibility, SMEs will once again be able to play a leading role in economic recovery.”

It is clear that leaders in the microfinance sector will have to act collectively as lenders of last resort to inject liquidity into the sector and to assist customers during this difficult time. The decades of work and achievements embodied in industry today place a critical responsibility on microfinance: to ensure that the most vulnerable can be able to benefit from the right opportunities.

In conclusion, as noted by the Financial Inclusion Advocacy Center[7], COVID-19 has clearly demonstrated that simple financial inclusion cannot help: what is required is sustained financial inclusion, that people who access funding are followed up and supported in a personalised way.

[1] https://www.franklintempleton.lu/download/en-lu/common/k9zjs2dd/esg-nmg-report.pdf

[2] https://www.sustainablefinance.ch/upload/cms/user/CorporateSustainability_Firstevidenceonmateriality_Khan_Serafeim_Yoon_February2015.pdf

[3] https://www.esma.europa.eu/sites/default/files/library/esma30-22-821_response_to_ec_consultation_on_a_renewed_sustainable_finance_strategy.pdf

[4] https://www.schroders.com/en/media-relations/newsroom/all_news_releases/schroders-global-investor-study-2019-peoples-sustainable-investment-ambitions-fail-to-reflect-their-actions/

[5] https://www.convergences.org/wp-content/uploads/2019/09/Microfinance-Barometer-2019_web-1.pdf

[6] https://academic.oup.com/oxrep/advance-article/doi/10.1093/oxrep/graa014/5828438

[7] https://www.smefinanceforum.org/post/publication-financial-inclusion-in-the-covid-19-era