The use of ESG (Environmental, Social, Governance) aims at representing and, above all, at measuring (and in the future even certifying) the ability of companies to calibrate and manage their impact in environmental, social and governance terms. The application of an ESG policy is expressed in the assignment of a real rating of sustainability which is expressed in a summary assessment of the environmental, social and governance impact of a company or organization operating on the market. The ESG rating appears increasingly important today because it represents synthetic data that allows investors to have a greater and deeper understanding of the sustainability of a company. We are faced with a positioning of companies increasingly oriented towards enhancing investments and choices designed for the environment, for social commitment and for implementing forms of business management for the benefit of the environment and territories.

In recent years, the perception of risks related to the environment in general has grown, as has the awareness of the responsibility of each of us to act. For many observers, the issue of sustainability has found a fundamental turning point in the Covid-19 emergency and in the various lockdowns. Sustainable ESG investments in the Agri-Food sector are keen to underline the need to pay attention to two fundamental factors: the commitment of several nations to sustainable agriculture and greater efficiency in the global system of food supply. In Italy, ESG investments in the Agri-Food sector are constantly growing. The numbers elaborated by the Smart Agrifood Observatory of the Politecnico di Milano and by the Rise Laboratory of the University of Brescia show an Italian market for Agriculture 4.0 which today is worth 450 million euros – driven by monitoring and control systems for vehicles and equipment (39 %), management software (20%) and machinery (14%)[1] – it emerges from these numbers and from the stories of company innovation how advantageous it is to invest in technologies that improve the quality and the sustainability of crops, solutions for competitiveness and innovations for traceability of products.

There is a strong pressure on the agricultural sector to innovate and adapt to reality, given the estimates indicating an increase of the population that will reach 11 billion in 2100.

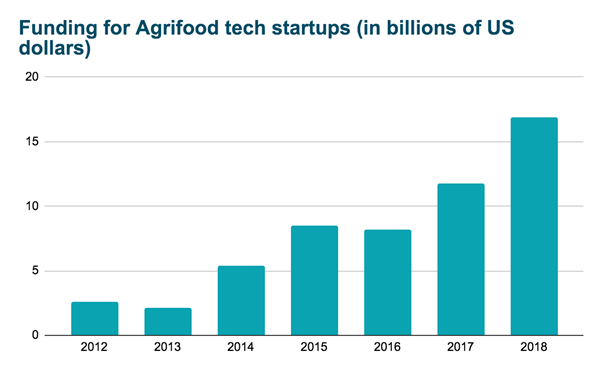

In fact, according to Agfunder, in the period 2014-2018, funding for startups linked to Agri-Food in the world increased by 550%, reaching a total amount of 17 billion dollars in 2018 . At the top of the ranking we find the United States and Canada: this is where more than half of the world’s economic efforts are concentrated, with 34 billion of resources used in the last ten years and more than 1300 players including startups and more mature companies.

Europe follows with 14.3 billion and Asia with more than 13 billion. «Silicon Valley, London and Israel, with over 1,000 startups focused on Agrifoodtech, are attracting more than 30% of global investments – according to the Talent Garden – and hubs like Singapore, Paris and Berlin are starting to emerge ». As for Italy, «the market is still unbalanced on Food rather than on Tech – Dattoli says – our economy is still a niche». However, it continues to grow in an interesting way reaching a value of 450 million euros in 2019 , according to data from the SmartAgrifood Observatory[2].

The health crisis due to Covid-19 does not seem to have had a pronounced impact on the growth of the sector, given that the growth trend continues to be maintained at a global level.

India, the second largest agricultural production country in the world, is even hoping for doubling its profit by 2022, regardless of the general economic situation.

[1] https://www.ilsole24ore.com/art/agrifood-40-come-tecnologia-aiuta-imprese-ad-affrattere-covid-19-ADNseGN

[2] https://www.ilsole24ore.com/art/l-avanzata-foodtech-17-billiardi-investimenti-2020-ADF6EVDB

The potential investment opportunities are vastly varied and diversified: in fact, there is no predefined and binding investment policy. The selection of investments in order to look for the best opportunities to generate value is therefore flexible in terms of size and sharing structure. A critical point, however, is to integrate investments in a food chain as much as possible to maximize business stability and profit management.

There are, however, some characteristics found in investments of this type. The first concerns the size of the investment, which is between € 1 – 10 million. The target, on the other hand, is composed of companies with an adequate market and technological position, growth opportunities and management needs. In addition, particular attention is paid to companies that can act as aggregators of smaller entities in fragmented markets. Investments in specific agricultural land, on the other hand, include strategies concerned with lands with good strategic positioning but poorly exploited, companies or lands with generational change and development projects for new high-margin crops.

The Agrifood Generation Fund (AFG), a fund under Luxembourg law with a particular focus on Italian investments, is part of this ecosystem of start-ups, scale ups and SMEs. Some examples of operations aligned with the objectives of the AFG fund are the Tuscan Agricultural Company and the Wine Value Chain. The first is in fact subject to an important generational substitution and the need to introduce crops with higher added value. Meanwhile, the second focuses on the creation of a vertically integrated supply chain operator and the enhancement of Italian regional wine through a single brand to be distributed internationally.

This investment proposal is part, as a natural continuation, of ESG and Impact Investing and also finds its roots in the operations carried out in the minibond sector (from Parmesan Bond to Pecorino Bond). Aleph Finance has developed several investments in Agri-Food over the years. The “Pecorino Bond” operation, for example, is indeed an initiative aimed at promoting the opening of new scenarios in support of Small and Medium Enterprises operating in Sardinia in the Agri-food sector. The project aims to confirm financial support for companies specializing in the production of Pecorino Romano and sheep’s milk derivatives. This particular form of minibond financing allows companies to diversify the source of their financing and reduce dependence on the banking system.

The European Investment Bank (EIB) has conducted a research[1] with the aim of exploring funding practices in R&D and innovation in the Agri-Food sector in Europe. This sector needs innovation not only for economic and technological reasons, but also social (many SDGs are directly connected to the Agri-Food value chain), environmental, demographic and technical (fragmentation of companies and low inclination to spend on innovation) ones.

Many experts believe that the best solution for the growth of the sector can be found in encouraging investments in R&D, for example by using new digitalisation-driven technologies in areas such as precision farming, sustainable packaging and blockchain-based food tracing, but not only.

Although the data shows growth in the sector, research also finds some critical issues caused by various interrelated issues. First of all, we are witnessing a high fragmentation of the European financing landscape. There are currently too many tools available that require knowledge in the financial sector, but most of the innovators in Agri-Food are very small companies or start-ups which therefore find it difficult to navigate the European multilevel financing and investment landscape. This information problem also affects investors themselves who need a high level of specialization: investors must be competent in the sector and therefore know that they have to invest the so-called “patient capital“.

Researchers of EIB have proposed some investment’s instruments in Agri-Tech, to facilitate access to the sector. In particular 3:

- Development and strengthening of crowd-lending platforms dedicated to innovators in Agri-Food. This form of financing makes the result of the investment tangible and transparent, appropriate for less experienced investors. To narrow the funding gap between small and large innovative companies, however, the help of financial institutions is needed. The use of equity offerings in crowdfunding platforms would allow the general public to invest in small companies, bringing capital to the innovators of the sector. This popular trend with a high communicative impact could also have a positive effect on the decisions of the Banks which, in turn, could become increasingly interested in financing this sector.

- Allowing the issuance of mini-bonds to share risk and unlock investments in order to create a risk barrier that unites small investors. This investment structure would give, especially to small farmers, an extra amount of money to invest in innovation and to share with other farms (e.g. cooperatives). A similar initiative has already been introduced in Italy in 2012 where legislation has favored this type of investment for SMEs not present on the financial market. A financing structure like this could foster larger loans possibly supported by tools to enhance access to credit.

- Exploring the development of financial risk-sharing tools dedicated to digital innovation, to data-driven Agri-Food innovators. The most innovative SMEs and start-ups find it difficult to find financing, even for small amounts (€ 5 million – € 30 million) even at the end of the development phase of the idea. This solution would solve one of the difficulties of the sector, namely the mobilization of financing even for these small sums.

Aleph Finance Group is already working hard to move in this direction, proving to be aware of the potential that this sector can offer. The companies of the group, in particular Aleph Finance and Opstart, have undertaken massive activities respectively concerning mini-bonds (such as Pecorino bond) and crowd-funding platforms, see for example the collection campaigns for Forever Bamboo, which have garnered huge success among investors.

[1] https://www.eib.org/attachments/thematic/feeding_future_generation_en.pdf